Yet another article in this morning's Post Gazette on property tax reform. Our state legislature is muttering once again about taking up the issue. This is after Gov. Rendell promised to ELIMINATE the school portion of our property taxes if his gambling buddies were allowed to do business in the state. We allowed them in, Rendell lied once again, and gambling monies will now be shuffled to many of Rendell's other buddies instead of the relief he promised. So what else is new? Homeowners (especially seniors) will be screwed once again and "Bait & Switch" Rendell just keeps smiling.

Yet another article in this morning's Post Gazette on property tax reform. Our state legislature is muttering once again about taking up the issue. This is after Gov. Rendell promised to ELIMINATE the school portion of our property taxes if his gambling buddies were allowed to do business in the state. We allowed them in, Rendell lied once again, and gambling monies will now be shuffled to many of Rendell's other buddies instead of the relief he promised. So what else is new? Homeowners (especially seniors) will be screwed once again and "Bait & Switch" Rendell just keeps smiling.Since reform of "Property Tax Reform" will be required before any meaningful reform takes place, the Pist-Gazette has sent the following email to Bill DeWeese, Keith McCall, Samuel Rohrer and every other legislator in Allegheny County. Maybe if they hear from thousands of us, they might listen. Legislator email addresses can be easily found here.

"Read in this morning's Post Gazette where you guys "might" take up property tax reform in the fall. As you must know property taxes are one of THE two main problems in PA, the other being our uncompetitive and downright antagonistic mindset toward private sector business.

As for property tax reform, you MUST do it. And if it is anything short of eliminating property tax on primary residences or eliminating the school portion completely, taxpayers MUST have referendum abilities in regards to the school taxes.

You know why this is. I won't trouble you with the obvious. Pennsylvania's per student spending is in the top 10 in the nation, its scores are in the bottom 10, etc., etc., etc.

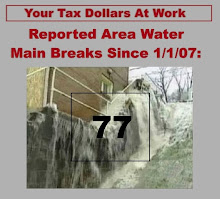

Do not mistake my boring "etc's" as a lack of passion on this issue. There is a level of outrage in the electorate that I'm sure you'll concede is unprecedented in recent times. Much of the outrage is over runaway taxes coupled with "services" that are laughable. 50 legislators got the boot last time around, but don't for a moment think this has mollified the citizenry.

I'm a real estate agent. I live with this daily. I see older folks frozen in fear as it becomes more and more obvious they cannot afford to live in the homes they've ALREADY PAID FOR. I help countless customers appeal their assessments, AND WIN, only to have the school district HIRE LAWYERS (paid for by the tax dollars of those who they are shaking down), drag the homeowner back to assessment court, and RE-APPEAL the new assessment on slightly different grounds. The property owner must fight again and again and again. Talk about double/triple/quadruple jeopardy!

I am NOT exaggerating. The schools will not give up until they have extorted something, anything. They have lawyers, they have time, but mostly, they have UNLIMITED resources which can be used for educating students, teacher salaries, school gymnasiums, OR LAWYERS WHO ACT AS BAG MEN insuring the uninterrupted flow of these "educational dollars". It is unfortunately their call and their call alone. I say "unlimited" because they can choose to raise the millage when they want, however much they want. Or they can choose to unleash their attorney attack dogs on the most vulnerable of the herd. Because they are cowards and jackals, they choose the latter.

If you bring "relief" to property taxes by shifting the burden elsewhere, without school district limits and accountability, the districts will be ecstatic I'm sure. They will gleefully rub their money-grubbing hands together thinking that homeowner "tolerance" for tax sticker-shock will have just been set back to square one. That will not be the case, but it won't matter. Schools will have just won the Lotto, one of PA's biggest problems will have just taken on a different form and nothing will have changed. Except that our dysfunctional clock will continue to tick, seniors will continue to lose their homes and Pennsylvania will continue its shameful slide to nowhere.

Please, please, please do something in earnest about this. You know what has to be done .... just suck it up and do it. Whether it is a .5 percent increase in sales tax or changing what is taxed or any combination thereof .... it does not matter. What matters is that you address the core of the problem which I have addressed above. Anything less than this will just put the problem off to some future date which is what you guys have been doing for decades.

This must stop and it must stop now."

2 comments:

Good post. I disagree with some of your generalizations regarding the education system, but the bottom-line is that property-tax reform is more critical than ever, for middle-class and fixed income homeowners, and those communities that cannot rely prop. taxes to fund their education system.

Reading some of our representatives' boneheaded suggestions, including the .5% increase in the sales tax, is just irritating. I have yet to figure out how the minimal windfall a .5% would create could be defined as "relief". Also, taxing food and clothing will end up squeezing those individuals most affected by the current property tax system from the consumption side. Its so damn stupid...

Post a Comment